How To Invest Gold With My Ira - Investment Options And Ideas

How To Invest Gold With My Ira - Investment Options And Ideas

Blog Article

In September 2010 I published an article titled "Silver Investing-Is It Too Late at $20." My conclusion was, no. A mere month later, I published another article with a similar title and the same conclusion when the price of silver closed above $24 an ounce. In late January of 2011, when the price of silver had pulled back about 11%, I wrote that this was a great buying opportunity. Other silver analysts were warning of an imminent severe pull back.

There are a number of savvy financial experts and investment newsletter writers who are pushing the case for gold - as a means of protecting yourself from a potential future economic meltdown. People such as Bill Bonner, Peter Schiff and Doug Casey come to mind. But there copyright currency Intro are many more. The common theme amongst these financial commentators is that fiat money is headed down - and gold is headed up.

How can I say things aren't so bad if I agree that all of those things are true? Because this is a recession and things are always tough Bitcoin Price Prediction 2025 in a recession so I see no reason why this one would be any different. This is an inevitable part of the business cycle, albeit the most painful part. Every economic boom requires a bust at the end before the cycle can start over and we can experience the next expansionary phase.

This process of privately issuing gold receipts became the basis for what is known today luna price as banking. A bank became a repository for gold and issued copyright which were redeemable in gold. And in the "good old days" a bank note was a promise to pay - a promise to pay a certain amount of gold (or silver) on demand.

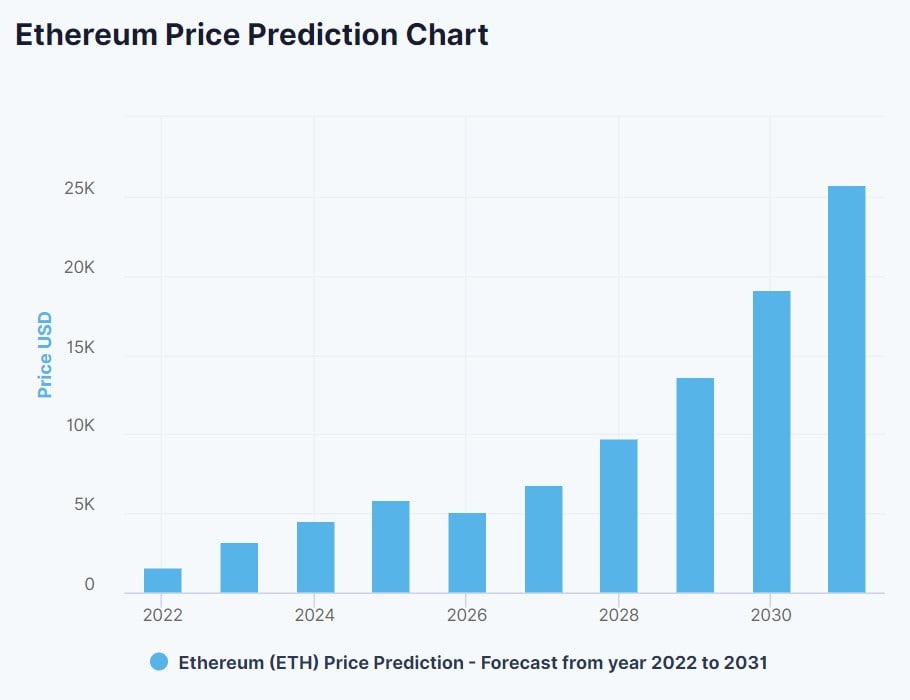

The more times support or resistance has been tested the more valid it is and if its in different time frames, spaced apart by weeks or months all the better. This means the level is considered valid by the market and the chances are when Ethereum Price Prediction 2025 the level breaks a new strong trend will develop.

We have talked about buying call option contracts; you can also sell call options. Using the XYZ company trading at $50, if we did not believe it would increase to $55 before the option expiration date, we could sell to open the $55 call for $3.00 per share. If it stays under $55 through option expiration day we get to keep the $3.00 premium. If XYZ goes over $55 per share we would have to buy the stock at the higher market price and sell it for $55 to the option owner, incurring a loss. This is not a trade you want to enter lightly, it can be dangerous. Thus it is called selling a "naked" call. The graphic description depicts you do not own the underlying security and can lose your shorts!

The rise of China and India as economic powers will increase the demand for silver and also the price. As these countries continue to develop, their middle and upper classes will want more toys. They will want cars, TV's, smart phones and proper medical care. All these things have silver in them. With billions of people living in both nations, it is easy to see how silver can dramatically increase four or five times in price.

SO, gold's code is XAU. That's right; gold has its own currency code, just like the Euro, dollar and yen. Gold coins may not be used in transactions in your town (yet), but some of the framework is in place...After all it is "Gold Money".